The electric vehicle (EV) market is undergoing a massive transformation, with Chinese automakers rapidly closing the gap—and in some cases, surpassing Tesla. Once the undisputed leader in the premium EV space, Tesla’s market share is shrinking, particularly in China, the world’s largest EV market.

Companies like BYD, XPeng, and Xiaomi are producing Evs that match or outperform Tesla’s offerings at a lower cost. With BYD overtaking Tesla as the world’s top EV seller in Q4 2023, and Chinese EV makers aggressively expanding into Europe, Latin America, and the Middle East, the global EV landscape is shifting fast.

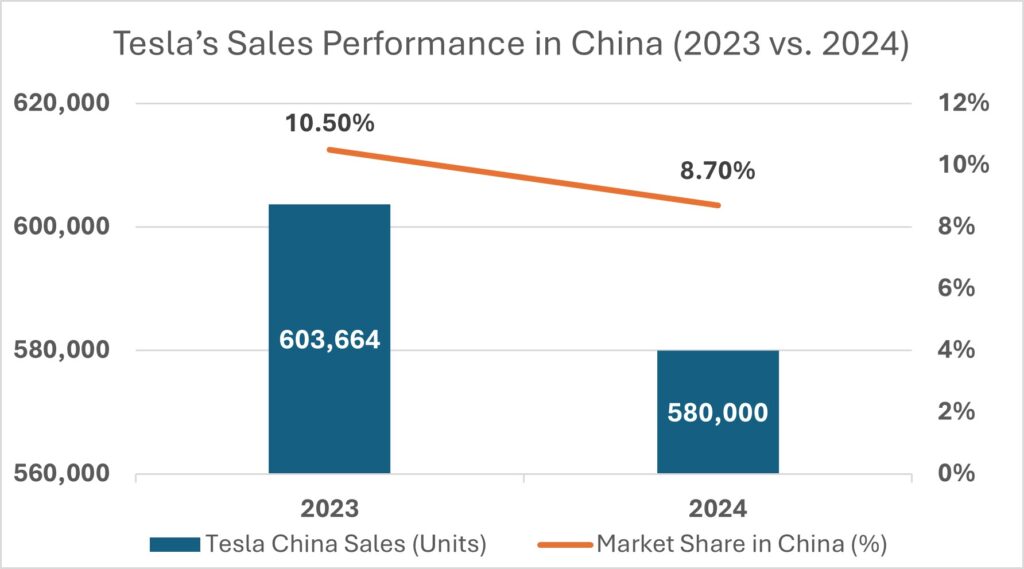

Tesla’s Market Share Decline in China

(Projected based on current trends)

- Tesla saw record sales in China in 2023, yet its market share shrank due to intense competition.

- BYD alone sold 3.02 million vehicles in 2023, dwarfing Tesla’s 1.81 million global deliveries.

- XPeng, NIO, and Xiaomi are rolling out cheaper and more feature-rich EVs at a faster pace, forcing Tesla to slash prices multiple times to remain competitive.

Elon Musk himself acknowledged the threat posed by Chinese EV makers, stating that they could “demolish competitors” globally without trade barriers. If Chinese EV makers continue their rapid expansion into Western markets, Tesla could face serious competition beyond China.

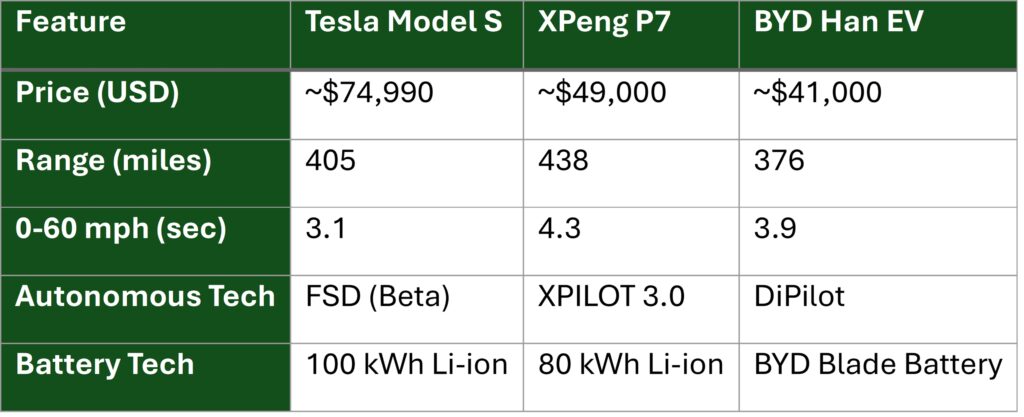

Model S vs. Chinese Rivals: A Feature & Price Comparison

Tesla’s Model S has long been considered the benchmark for luxury EVs, but Chinese automakers have caught up—and in some ways, surpassed it.

Comparison: Tesla Model S vs. XPeng P7 vs. BYD Han EV

- XPeng P7 offers a longer range than the Model S—while costing $25,000 less.

- BYD’s Han EV is even cheaper and uses BYD’s Blade Battery, which is safer and less prone to overheating than Tesla’s standard lithium-ion packs.

- Tesla’s Full Self-Driving (FSD) is still in beta, whereas XPeng’s XPILOT 3.0 and BYD’s DiPilot offer competitive autonomous driving features at a lower cost.

With these advantages, Chinese automakers are proving that Tesla is no longer the only player in the high-performance EV market.

Global EV Trends Worrying for Tesla

China’s EV manufacturers are not just dominating their home market—they are aggressively expanding into Europe, the Middle East, and Latin America.

Zooming in on BYD’s Global Expansion:

- Europe: Opened a factory in Hungary and plans to sell 800,000+ units in 2025.

- South America: BYD already controls over 50% of the EV market in Brazil.

- Middle East: Expanding into UAE, Saudi Arabia, and Israel, where demand for EVs is rising.

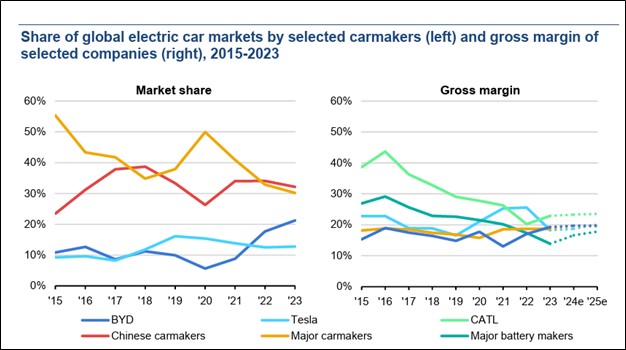

Global Market Share Trends

Data Source: International Energy Agency – Global EV Outlook 2024

Tesla’s business strategy of higher profitability per vehicle may soon not be enough to compete with Chinese carmakers’ volume-based growth.

Why Chinese EVs Are Winning

1. Lower Prices & Government Support

- China’s government subsidizes EV production, making Chinese EVs significantly cheaper.

- BYD produces its own batteries, unlike Tesla, which still relies on suppliers like Panasonic and CATL.

2. Faster Innovation Cycles

- XPeng, NIO, and Xiaomi update their models every 12–18 months, whereas Tesla’s Model S has largely remained unchanged for over a decade.

- BYD and Xiaomi have already introduced next-gen EVs, while Tesla is still delaying the release of its $25,000 affordable EV.

3. Battery Technology Leadership

- BYD’s Blade Battery is safer, cheaper, and lasts longer than Tesla’s lithium-ion batteries.

- China’s CATL supplies over 30% of the world’s EV batteries, giving local automakers a supply chain advantage.

The Future: Can the West Compete?

Western governments are already raising tariffs and investigating Chinese subsidies to slow down Chinese EV imports.

The US already has tariffs on Chinese EVs, but brands like BYD and NIO are finding ways to enter through Mexico to bypass them.

The EU is investigating China’s EV pricing strategies, fearing an influx of low-cost, high-tech Chinese vehicles could undercut European automakers.

Tesla is acutely aware of the growing competition in the global EV market and is already making strategic moves:

- Lowering Prices: Tesla has slashed prices multiple times to remain competitive.

- New Model Development: A cheaper $25,000 Tesla is in the works, targeting the mass market.

- AI & FSD Leadership: Tesla’s Full Self-Driving (FSD) remains one of its biggest strengths.

However, Tesla’s ability to maintain its dominance depends on how well it adapts to lower-cost competition. With Chinese EV makers improving quality and expanding globally, the pressure on Tesla will only increase.

The battle for EV supremacy is no longer just about Tesla—it’s now a global fight in which China holds the advantage in terms of price, innovation, and supply chain control. With demand for EVs expected to continue rising, falling short now may prove too costly for any player.