The battery revolution is accelerating, driven by rapid advancements in energy density, charging speed, and material sustainability. With CATL, BYD, and other major players leading innovation, the coming years will reshape how energy is stored and utilized across industries. This article explores the latest advancements, key industry players, and the market trends driving the future of battery technology.

Advancements in Battery Technology

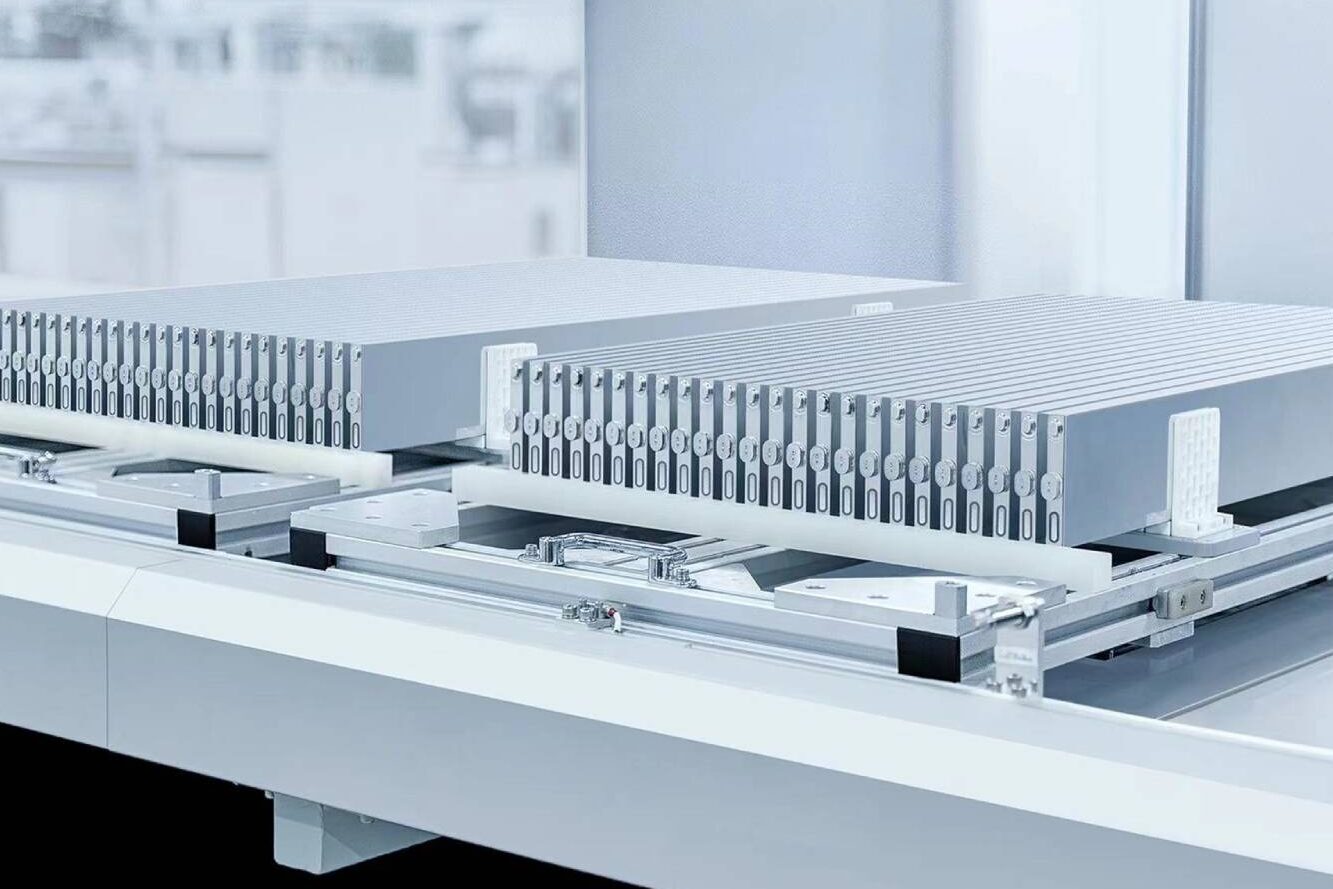

1. Qilin Battery – CATL’s Breakthrough

Chinese battery giant CATL has begun production of its Qilin battery, which boasts a higher energy density and improved efficiency for electric vehicles (EVs). This battery utilizes CATL’s third-generation cell-to-pack (CTP) technology, which enables better heat dissipation and an improved 6C ultra-fast charging rate, reducing charging times significantly.The Qilin battery from CATL has an energy density of up to 255 watt-hours per kilogram (Wh/kg) for NMC cells and 160 Wh/kg for LFP cells. The Qilin battery has a record-breaking volume utilization efficiency of 72% which translates into powering an electric vehicle for 1,000 kilometers (620 miles) on a single charge.

2. BYD’s Blade Battery 2.0 – A New Era

BYD is preparing to launch the second generation of its Blade Battery by 2025. The new model will offer:

- Energy density up to 210 Wh/kg, an improvement from the current 150 Wh/kg.

- 8C ultra-fast charging, enabling a full charge in about 7.5 minutes.

- Enhanced lifespan, reducing battery degradation over time.

This innovation makes LFP (lithium iron phosphate) batteries more competitive against nickel-based chemistries.

3. The Rise of Sodium-Ion Batteries

The U.S. Department of Energy’s $50 million LENS consortium is leading a push to commercialize sodium-ion batteries, which offer a low-cost, abundant alternative to lithium-ion cells. Companies like CATL and Faradion are also investing in this technology, which has potential applications in both EVs and grid storage.

4. Solid-State Batteries – The Holy Grail of Energy Storage

Solid-state batteries replace liquid electrolytes with solid electrolytes, making them safer and more energy-dense. Toyota, QuantumScape, and Samsung SDI are leading the charge in this area. Although commercialization is still a few years away, these batteries could double the range of EVs while reducing safety risks.

Market Trends and Key Players

1. China’s Dominance

The country currently holds nearly 70% of the market for cutting-edge battery technology. CATL and BYD continue to dominate the Chinese power battery market, with CATL holding 45.2% market share (256.01 GWh installed capacity) and BYD claiming 25.1% market share (135.02 GWh installed capacity). CATL and BYD are also part of a Chinese government-backed consortium to rapidly commercialize solid-state technology.

The companies are aggressively expanding globally, with CATL’s European and U.S. factory investments solidifying its position.

Image Source: Australia Strategic Policy Institute, Critical Technology Tracker, 2024

In Japan, Toyota and Nissan are aiming for production by 2028, while South Korea’s Samsung plans mass production for premium vehicles by 2027.While this may have been concerning for Tesla’s North American stronghold, the new Trump Administration’s sanctions on Chinese imports, including raw materials for batteries, may preserve Tesla’s dominance, at least in the incumbent.

2. Expansion of LFP Batteries

LFP batteries now make up 74.6% of China’s battery installations. Their affordability, safety, and durability have made them a top choice for EVs, especially in budget and mid-range models.

3. Energy Storage Beyond EVs

Next-generation batteries are not just for electric vehicles. Companies are repurposing used EV batteries for grid storage, ensuring a second life for these cells in stabilizing renewable energy grids.

What to Expect in The Future

- Ultra-Fast Charging Becomes Standard: With 6C and 8C charging technologies from CATL and BYD, charging times are dropping below 10 minutes. This could eliminate range anxiety and make EVs more convenient than ever.

- Diversification of Battery Chemistry

- Sodium-ion batteries may replace lithium-ion in energy storage and budget EVs.

- Solid-state batteries will push the boundaries of performance and safety.

- Lithium-sulfur batteries could offer even higher energy densities for aerospace applications.

- Increased Battery Recycling and Sustainability: Governments and automakers are focusing on recycling initiatives to create a circular economy for battery materials. BYD and Tesla are already working on second-life applications for used EV batteries.

A lot more research and engineering prowess is still required to improve the scale and speed of innovative next-generation batteries. Whether its China or the US leading the race, the renewable energy sector is set to benefit vastly form these improvements, none perhaps more than the Electric Vehicle and Solar industry. Nevertheless, one can consider this a win for sustainability.